what is the tax rate in tulsa ok

The median property tax in Tulsa County Oklahoma is 1344 per year for a home worth the median value of 126200. Whether you are already a resident or just considering moving to Tulsa County to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

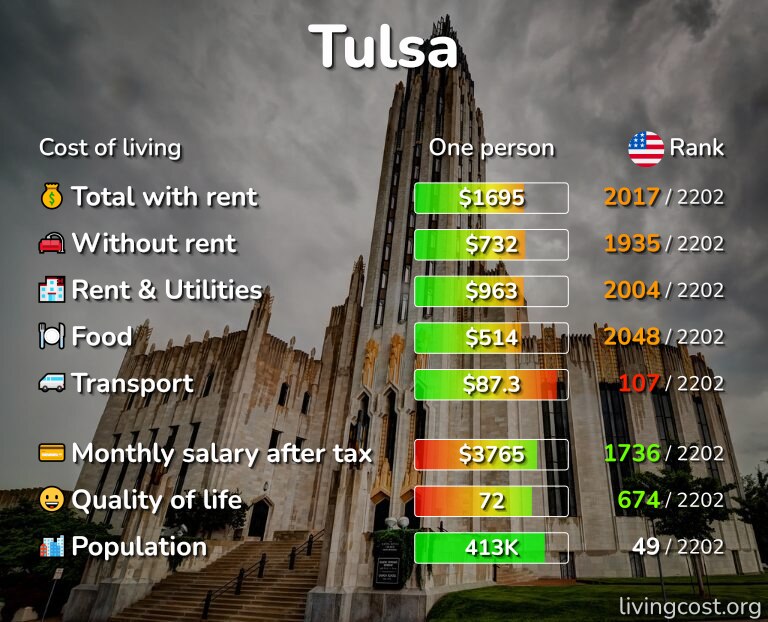

Tulsa Ok Cost Of Living Salaries Prices For Rent Food

Creating tax rates evaluating property worth and then receiving the tax.

. 4 rows The current total local sales tax rate in Tulsa OK is 8517. The minimum combined 2022 sales tax rate for Tulsa Oklahoma is. Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions.

31 rows The state sales tax rate in Oklahoma is 4500. If a city or county is not listed they do not have a sales or use tax. Effective May 1 1990 the State of Oklahoma Tax Rate is 45.

Tax rate of 5 on taxable income over 12200. Tulsa in Oklahoma has a tax rate of 852 for 2022 this includes the Oklahoma Sales Tax Rate of 45 and Local Sales Tax Rates in Tulsa totaling 402. The City has five major tax categories and collectively they provide 52 of the projected revenue.

The Tulsa Sales Tax is collected by the merchant on all qualifying sales made within Tulsa. 087 average effective rate. While Oklahoma law allows municipalities to collect a local option sales tax of up to 2 Tulsa does not currently collect a local sales tax.

Changes in Tax Rates. Has impacted many state nexus laws and sales tax collection requirements. The Oklahoma state sales tax rate is currently.

Tulsa OK 74119. Yearly median tax in Tulsa County. Learn all about Tulsa County real estate tax.

2 to general fund. The 2018 United States Supreme Court decision in South Dakota v. In general there are three aspects to real estate taxation.

With local taxes the total sales tax rate. Accorded by state law the government of Tulsa public hospitals and thousands of various special purpose districts are empowered to appraise housing market value establish tax rates and levy the tax. A county-wide sales tax rate of 0367 is applicable.

918 596-5100 Fax. Oklahoma State Tax Quick Facts. For the Single Married Filing Jointly Married Filing Separately and Head of Household filing statuses the OK tax rates and the number of.

In addition Tulsa County makes every effort to ensure the information is current. The Tulsa Oklahoma sales tax is 450 the same as the Oklahoma state sales tax. Tulsa County collects on average 106 of a propertys assessed fair market value as property tax.

You can find more tax rates and allowances for Tulsa and Oklahoma in the 2022 Oklahoma Tax Tables. Tax rate of 4 on taxable income between 9801 and 12200. Tulsa County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax collections.

The minimum combined 2022 sales tax rate for Tulsa County Oklahoma is. Just enter the five-digit zip. The information on these pages has been carefully compiled to ensure maximum accuracy.

With six marginal tax brackets based upon taxable income payroll taxes in Oklahoma are progressive. State of Oklahoma - 45. Tulsa Sales Tax Rates for 2022.

Oklahoma has recent rate changes Thu Jul 01 2021. The Oklahoma state sales tax rate is currently. The December 2020 total local sales tax rate was also 8517.

Tax rates range from 025 to 475. The Oklahoma sales tax rate is currently. The County sales tax rate is.

The current total local sales tax rate in Tulsa OK is 8517. Tulsa County Headquarters 5th floor 218 W. The Tulsa County Sales Tax is 0367.

The Tulsa County sales tax rate is. The countys average effective property tax rate of 113 is above both the state average of 087 and the national average of 107. Single filers will pay the top rate after earning 7200 in taxable income per year.

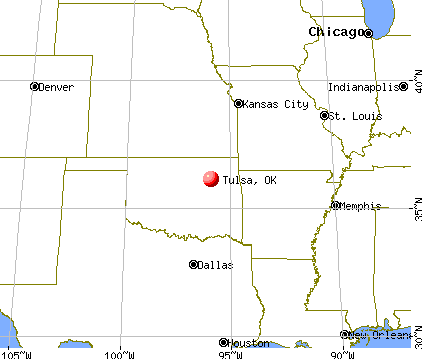

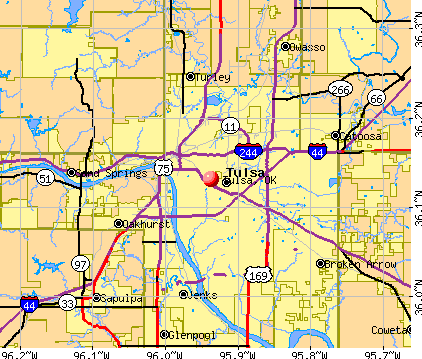

Situated along the Arkansas River in northeast Oklahoma Tulsa County has the second highest property tax rates in the state. This is the total of state county and city sales tax rates. The December 2020 total.

Sales tax at 365. The median property tax also known as real estate tax in Tulsa County is 134400 per year based on a median home value of 12620000 and a median effective property tax rate of 106 of property value. County of Tulsa 2021 Levies Detail.

The Tulsa sales tax rate is. Use this calculator for Tulsa County properties. Wright Tulsa County Assessor.

Tulsa County - 0367. 2021 Tulsa County Tax Rates. Oklahoma is ranked 972nd of the 3143 counties in the United States in order of the median amount of property taxes collected.

This is the total of state and county sales tax rates. 4 rows The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367.

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

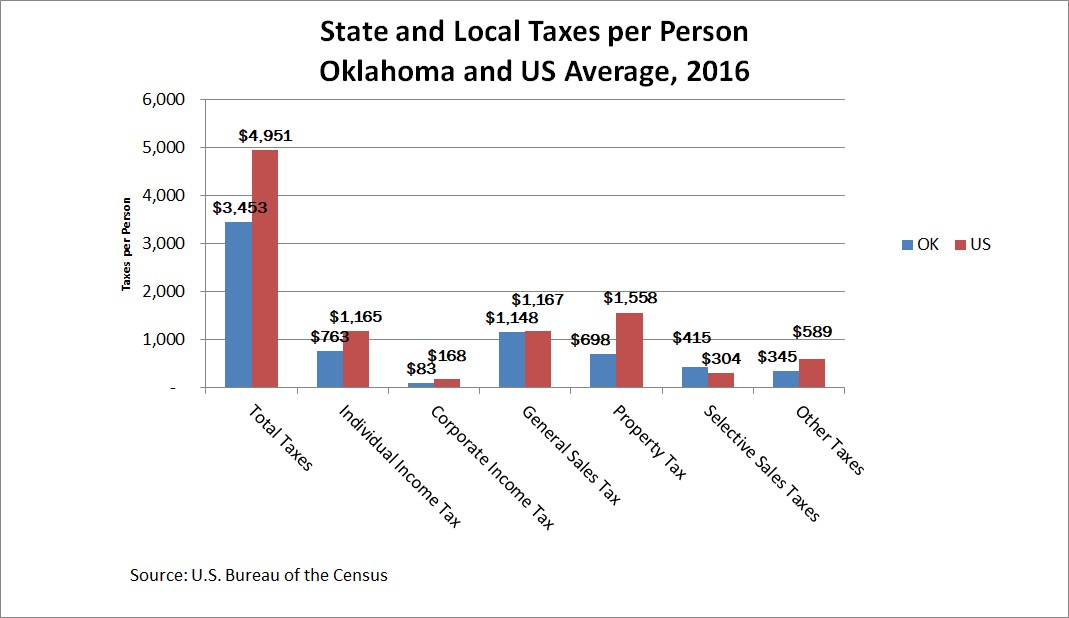

How Oklahoma Taxes Compare Oklahoma Policy Institute

13 Photos Of Oklahoma In The 1960s

The Plaza Shopping Center Price Edwards And Company

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Map Of Tulsa Oklahoma Area What Is Tulsa Known For Best Hotels Home

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Oklahoma Sales Tax Small Business Guide Truic

Best Assisted Living In Tulsa Ok Retirement Living

Albuquerque Vs Tulsa Where Is The Best Place To Live Combadi World Travel Site

Pros And Cons Of Living In Tulsa Ok Securcare Self Storage Blog

Pros And Cons Of Living In Tulsa Ok Securcare Self Storage Blog

Hitch It Trailer Sales Trailer Parts Service Truck Accessories Aqua Lily Pad Lake Fun Floating In Water

Oklahoma Lawmakers Studying Worsening Teacher Shortage Kesq Wall Of Sound Teacher Shortage Japanese Film

Tulsa County Oklahoma Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Amazon Delivers In Tulsa With Electric Vehicles Oklahoma Department Of Commerce

Pros And Cons Of Living In Tulsa Ok Securcare Self Storage Blog